What is an NFT?

NFT stands for Non-fungible token. This means that it is completely unique, there will never be anything like it, a one of a kind so to speak. A good comparison would be a rare baseball card in a certain condition, there will be similar cards, but never one in identical condition. Most NFT’s are essentially a one of a kind piece of digital art. The most common that we are seeing right now are avatars that people use for their social media profile pictures.

Can’t I just save the image?

Well yes, you can, in the same way you can take a picture of the Mona Lisa… but it doesn’t mean you own it. NFTs are designed to give you something that can’t be copied: ownership of the work. Also by owning the art you can display it in your own virtual art gallery (and even physical if you have the means to display it). It’s also important to note that once you buy one of these NFT’s you become a part of the community, and this is questionably one of the biggest reasons some people buy certain NFT’s to be a part of the “owners club” which some NFT’s transcend to physical events, parties etc.

How do I get involved?

So there are two ways you can buy an NFT. You either “mint” it or buy it on an aftermarket platform such as Opensea. What is minting you may ask? Minting is the process of registering a piece of art on the blockchain, most NFT are hosted on either the Ethereum or Solana blockchains. When a new project is released you can have a chance at minting that project for a “mint price” which is where people can profit, as there are a lot of people trying to mint a profit, people will lose out and therefore punters will head to the aftermarket platforms to purchase the NFT for resale price.

How do i know what projects to buy?

You can profit from minting new NFT projects, but not ALL releases are profitable. Due to the huge growth in the NFT scene there are a lot of scam projects coming out daily, and it is hard to differ between legitimate releases and ones that are a scam (we call these a rug pull). Inside our group we help out with daily guides as to which, if any, projects are worth trying to mint. We often find that there is a lot of money to be made buying and then reselling projects completely on the aftermarket, rather than trying to mint. There is often less risk that way as you already know the project is not a scam.

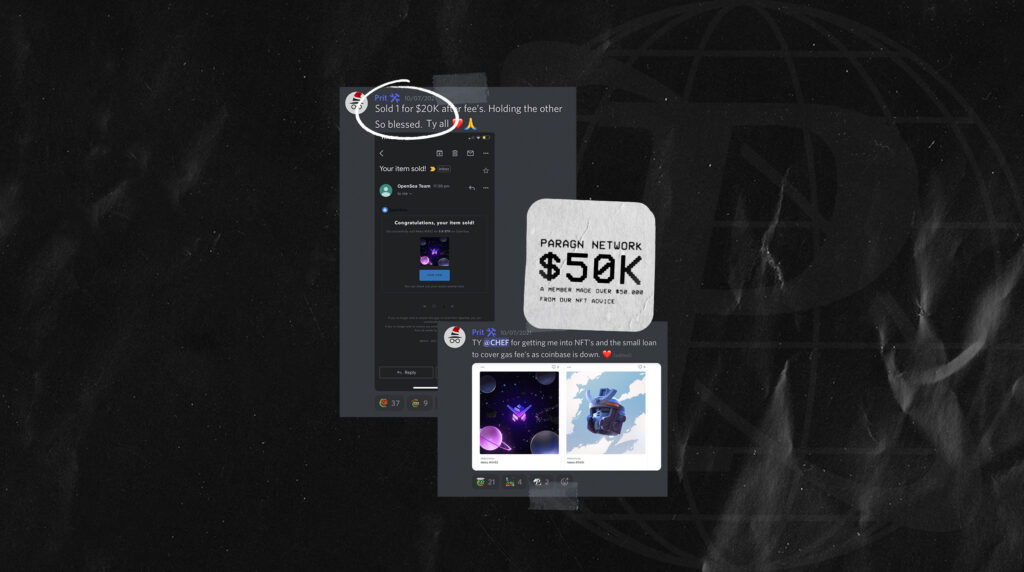

What sort of figures are we talking?

Let’s use one of our own calls as an example. We told our members to signup for a raffle, winners of the raffle were allowed to mint 2 “Mekaverse” NFT’s. At the time it was one of the most expensive mint prices, at 0.2 ETH per ($400) it was a risk, but we knew it would do well. Once of our members followed our call and bought two for a total of $800 give or take. He then went on to sell both for a total of $50,000 … yes that’s right, he made $49,000 profit in a matter of minutes. This is the crazy world of NFT’s and why it cannot be ignored. Granted this could be a bubble, but until it pops, we are all for it.